China’s Pharmaceutical Industry will be the world’s largest in under 10 years

Original Link: https://daxueconsulting.com/pharmaceutical-industry-china/

Pharmaceuticals play an important role in the global health system by diagnosing, curing, treating and preventing diseases. The pharmaceutical industry in China has experienced rapid progress since entering the World Trade Organization. The rapid rise of China’s healthcare industry has allowed it to begin the transition from being a pharmaceutical manufacturing base to a strategic R&D hub. As a result, China has cemented itself as a strategic player in the global pharmaceutical market, both as a consumer country and as a platform for establishing greater R&D. China’s pharmaceutical industry is pushed to grow with government incentives and public insurance, but hindered by IP laws and tedious regulations.

However, at the present moment China only possesses 11% of the global pharmaceutical market. The United States coming in first was the largest pharmaceutical market in 2018, and generated a 40.4% share of total revenues worldwide. This means the pharmaceutical market in China has a lot of consolidation to do. As a result, in the future this will open to door for many companies and businesses looking to find the right market opportunities and niche positions along the Chinese pharmaceutical value chain.

The Government’s Efforts in Bolstering China’s Pharmaceutical Industry

The challenge for China to solve is the issue of promoting growth in the pharmaceutical industry while ensuring affordable and easily accessible drugs for its patient population. In tackling this issue, the central government has emphasized a top down approach. In addition to investing heavily, the government has rolled out a series of broad changes to the pharmaceutical regulatory environment. The policy agendas outlined in China’s 13th Five-Year Plan and Healthy China 2030 initiative each reinforce the importance of healthcare reforms such as decreasing inequality in the insurance coverage ranges and strengthening public services. Reform measures within the industry have also aimed at increasing access to medicine and making medicine affordable.

Pharmaceutical policy in China has historically been relatively disjointed and uncoordinated between provinces, but these initiatives show that China is working towards restructuring the industry with the objective of improving its ability to compete internationally while still ensuring that the benefits are passed to the patient.

Along these lines, as part of the “Made in China 2025” industrial plan, China hopes to reinvent its pharmaceutical industry. The pharmaceutical industry is a high-technology field that requires massive amounts of research and development. However, with such high investment costs, most Chinese companies are simply priced out. Beijing’s ultimate goal for China’s pharmaceutical industry is to create national champion companies that can dominate the Chinese market, compete and beat foreign competitors, and begin to take market share abroad.

China’s Pharmaceutical Manufacturing Industry

Because China pursued policies of self-sufficiency from the 1940s to the 1980s it developed its pharma industry to meet local needs, it established large industrial zones and infrastructure to support the pharmaceutical manufacturing industry. It had its own standards and frameworks in terms of drug development that were very different from international standards. Since joining the WTO in 2001, China had to change many of these policies and regulatory frameworks. However, many of the largest domestic pharmaceutical companies in China are majority state-owned, but with shares listed on public securities exchanges, i.e. mixed public and private ownership.

China’s pharmaceutical manufacturing industry developed when the country was relatively isolated from international trade. In particular, the pharmaceutical manufacturing industry manufactures chemical medicinal and pharmaceutical products in various formats, including ampoules, tablets, capsules, vials, ointments, powders, solutions, suspensions and radioactive medicine. These products are then sold through pharmacies or used in hospitals. China’s pharmaceutical manufacturing sector supplied the needs of the country’s population and grew rapidly as the nation transitioned from a centrally planned economy to a market based economy. Thus, it is evident that the pharmaceutical manufacturing industry is an important part of China’s national economy.

China has more than 5000 pharmaceutical manufacturers, and the Government is strongly promoting consolidation of the pharmaceutical industry, especially to reduce the number of smaller companies that do not have the financial capacity to meet new regulatory standards.

Chinese pharmaceutical manufacturers have largely concentrated on the production of basic chemicals, intermediates and active pharmaceutical ingredients (APIs). In a relatively short period of time, China has become the leading global supplier of APIs in terms of volume. More recently, Chinese manufacturers have become focused on the development and production of finished pharmaceutical products (FPPs), primarily to serve the domestic market, but with increasing attention to export markets.

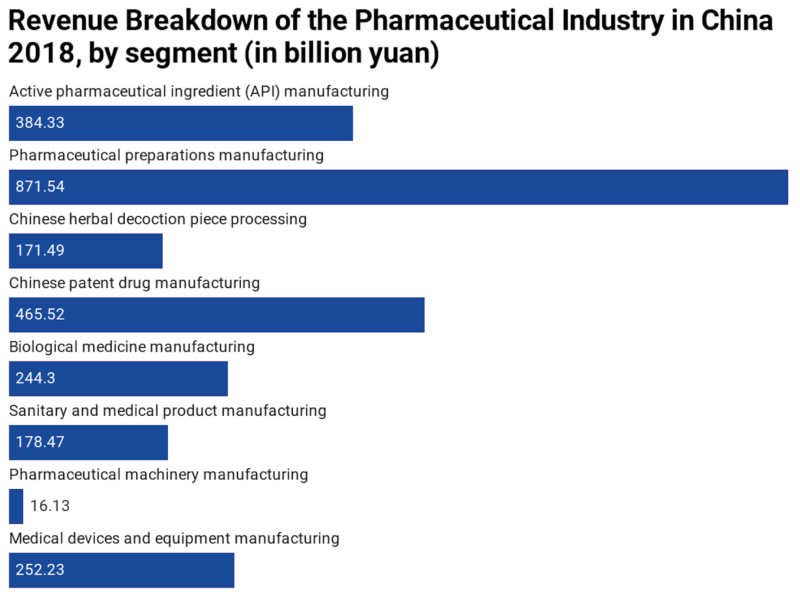

The statistic below shows a breakdown of the prime operating revenue of China’s pharmaceutical manufacturing industry in 2018, by segment. In 2018, the total revenue of China’s pharmaceutical industry amounted to 2.6 trillion yuan.

[Source: Statista, China MIIT]

Current State of China’s Pharmaceutical Market

Chinese pharmaceutical companies are mostly engaged in the production of generics, therapeutic medicines, active pharmaceutical ingredients, and traditional Chinese medicine. More than 90% of drugs registered in China are generic.

China’s pharmaceutical market is also highly fragmented, comprising of approximately 5,000 manufacturers, a majority of which are small and medium-size companies. For Chinese companies, this fragmentation has kept R&D spending to as low as 5% of sales on average. Although highly fragmented, global pharma and biopharmaceutical players such as Novartis, Novo Nordisk, and AstraZeneca, have a significant hold capturing at least 8-10% of the market. The market is highly dependent on its distributor networks, leading pharma players including Sinopharm and Shanghai Pharmaceuticals have strong control over these networks.

As a result of the industry’s fragmentation, the government has been seeking to consolidate the pharmaceutical sector and increase the average size of firms to support quality inspection and improvement. The latest national recommendation for the 13th Five-Year Plan specifically aimed to have all medicine on the National Essential Drug List go through bio-equivalence testing by 2020.

Major medical reforms

Thus, major medical reforms have been enacted to boost the Chinese pharma industry’s maturity and growth. These reforms have been addressed to tackle stringent drug quality regulations, incentivize medicine innovation, and reduce intermediaries within the pharmaceutical distribution sector. Moreover, the National Medical Products Administration (NMPA) adjusted its testing requirements regarding the quality of off-patent generic drugs to lift industry standards and bring to speed foreign drug reviews.

Overseas investment into China’s domestic pharmaceutical industry and the number of international companies bringing products into the Chinese market have also continued to grow. In 2017, China joined the International Council for Harmonization. Subsequent this announcement, China promised to gradually transform its pharmaceutical regulatory authorities, industry, and research institutions to implement the international coalition’s technical standards and guidelines. As a result, these actions initiated the true integration of China’s drug regulatory system into the international community.

China’s pharmaceutical industry has some advantages over foreign countries when it comes to producing drugs. It can more easily and quickly recruit sufficient numbers of patients for testing vaccinations on rare diseases. These pools of patients are less common in the US or other western countries. The greater the access to these patients, the more likely Chinese scientists are to develop ground-breaking new drugs and treatments. More clinical data is available in China although clinical data is held and sold to pharma companies on a provincial level which makes it harder for international pharma companies to obtain.

Around 2015, there was a switch in the China pharma industry away from focusing solely on creating generic drugs to creating more innovative drugs. However, 97% of drugs sold by local Chinese companies are generic.

China’s pharmaceutical market key players

[Source: Personal Graphic]

Size of China’s Pharmaceutical Market

China’s pharmaceutical market has been constantly growing in recent years. It is estimated to reach $161.8 billion by 2023 and take a 30% share of the global market. As of 2018, China’s pharmaceutical market was valued at $134.6 billion, with prescription medicine uptake accounting for 86.4% of total drug expenditure. The Chinese pharmaceutical market segments include generics, OTC, and patented medicines.

Due to low purchasing power and a robust local manufacturing sector, generic drugs ($85.3 billion) seized a large share of China’s pharmaceutical market ($219.9 billion). Sales of over-the-counter (OTC) medicines ($18.4 billion), which represent 13.6% of the market are supported by a cultural acceptance of self-medication and fairly liberal sales channels. Patented medicines ($30 billion), which are primarily consumed by China’s affluent class contributed a small portion (22.9%) to overall pharmaceutical sales.

Although China has expanded to be the second largest pharmaceutical market worldwide, growth has slowed from a 19% CAGR in 2008–2013 to an 8% CAGR in 2013–2018. On top of this, the market is expected to continue to decline to 3-6% through 2023. Much of China’s growth over the past ten years has been driven by central government reforms to expand insurance access to both rural and urban residents, to expand and modernize the hospital system, and reforms to better integrate primary care services. Growth moving forward will be attributed to the improvement of treatment concepts, the optimization of medical measures, the acceleration of new drug access, the improvement of medical service quality, and the dynamic adjustment of medical insurance access.

Key Products in China’s Pharmaceutical Industry

1) Generic medicine (60% of industry revenue)

Generics include: anti-infective drugs (the leading generics segment), cardiovascular system drugs (second largest market with the highest ROI), anti-tumor and cancer drugs, and drugs for the digestive system.

Generic drugs are the mainstay of China’s pharmaceutical industry. Due to large market demand this segment’s revenue is expected to increase strongly in future years. This is because China will likely continue to rely upon widespread prescription of generics in its public insurance plan to minimize overall healthcare expenditures.

Increasing generic penetration as a means to reduce pharmaceutical expenditure will render generic drugs more important in total drug sales, driving growth in the pharmaceutical market. China has seen significant investment by foreign drugmakers in the country’s generic medicine industry, and foreign drugmakers are making inroads in China through partnerships with local firms. In 2017, for instance, Teva formed a joint venture with Guangzhou Pharma to sell generic medicines in the country. In addition, Pfizer and Zhejiang Hisun Pharmaceuticals, a leading Chinese pharmaceutical company, announced the launch of Hisun-Pfizer Pharmaceuticals, a joint venture formed between the two companies to develop, manufacture and commercialize off patent pharmaceutical products in China and global markets.

2) Patent medicine (25.3% of industry revenue)

Patent medicine is the second-largest product segment and has characteristically high profit and technology levels. But, it also possesses high R&D costs, long R&D periods, and long return periods. Providing a boost to the market outlook is the renewed focus on improving the regulatory environment for patented medicines. Healthcare reforms provide long-term upside risk to patented medicine market growth given increases in medicine accessibility. However, the high-cost nature of innovative medicines will remain restrictive to the lower-middle income population segments.

Foreign companies are the main participants in this niche market, which is expected to produce growth rates of up to 10.0% annually in the coming years. Thus, there is a niche market for Chinese and foreign MNCs to target in this segment.

3) OTC Medicine (14.2% of total industry revenue)

China’s OTC medicine market remains one of the most attractive in APAC region with a significant market share. However, government focus on improving access to prescription medicines will reduce demand for OTC drugs leading to an erosion of market share over the long term. However, because in developed countries this segment accounts for between 30% and 40% of total industry revenue, OTCs may have new life in China. Thus, OTCs in China are expected to offer significant opportunities in future years, with many foreign companies looking to develop the segment.

[Source: IBISWorld]

Major Markets for China Pharma

1. The first major market for pharmaceutical products in China are urban and rural hospitals.

Increased population flows from villages to cities will lead to an increased demand and supply of medicines. Furthermore, as suppliers and wholesalers look to penetrate the market, and more people acquire medical insurance, payment for healthcare will increase and boost the pharma market. Pharmaceutical companies in China distribute their product to wholesalers who then distribute 80% of pharmaceutical end sales to the hospitals for patient use.

2. The second major market is drugstores.

Because pharmacies and drug retailers are the second largest sales channel and are expanding their coverage, expanding regional pharmacies will promote the industry segment in tandem with increased providing of OTC medicines and prescription pharmaceuticals.

3. Third, online sales.

Online sales will be an increasingly important market channel in line with the popularity of online shopping in China in general. This will improve pharmaceutical logistics systems and cut costs.

4. And lastly, exports.

Exports will remain steady in the next few years as China’s pharmaceutical industry matures and starts looking towards fulfilling domestic demand and expanding abroad.

China exports pharmaceutical products to over 160 countries and areas. Chinese exports are seeing continued and robust growth due to high demand for generic medicines. Export growth will be further influenced by multinational companies entering the Chinese market, domestic companies expanding to foreign markets, and the Chinese government’s emphasis on exporting pharmaceuticals as a key driver for the industry.

Demand Determinants for Growth

China’s pharmaceutical industry growth determinants are reliant on supportive government policies, favorable healthcare insurance coverage rates, advancements in medical technology, stable economic conditions, and increased demand from professional health practitioners. Hence, the full supply chain is essential for the healthy functioning of the Chinese pharmaceutical industry.

Approximately 60% of China’s domestic demand comes from generic pharmaceutical and medicine products. Antibiotics are regular medicines required by hospitals and are therefore the leading generic products demanded from the industry. Demand from rural hospitals has increased mainly due to rising incomes in rural areas, increased government aid, and a growing awareness for health. Demand for anti-tumor drugs and cardiovascular system drugs has also been high due to increasing rates of these diseases. This demand has boosted profitability as margins on these drugs are high.

Growth in the industry moving forward will be mainly driven by China’s strong economy, higher household incomes, aging population, growth in the rural hospital market, and supportive government policies. In the past, many consumers could not afford to purchase medicine or see a doctor. Hence, the government will continue to restrict and decrease medicine prices to allow more consumers to purchase medicine when necessary. Low-priced medicine will increase demand from low-income consumers.

[Source: Personal Graphic, the supply chain for China’s pharmaceutical industry]

Pharmaceutical Trade and Investment in China – Challenges and Opportunities

Despite the remarkable prosperity of the market, the Chinese pharmaceutical industry is facing some grave challenges. First, the implementation of the new ‘Good Manufacturing Practices’ and waste-water discharge standards have raised production costs. Second, a policy demanding adjustments to drug prices every three years has substantially decreased profits. And third, both the rising standards in the registration for new products and tightening of the licensing for existing products have impeded the launch of new products. In essence, market regulation of the pharmaceutical industry in China is relatively strict, especially market entry and price control.

Although the Chinese pharmaceutical industry has been developing fast in terms of market size and revenue volumes, the scale of Chinese pharmaceutical companies remains relatively small with a low market concentration. Therefore, local pharmaceutical companies with higher R&D input are generally less profitable. Although there have been increases in the number of patented drugs in the pharmaceutical industry in China, patents have made relatively low contribution to the industrial values. On top of this, IP held by Chinese firms is less competitive compared with that of foreign companies and most of the pharmaceutical enterprises in China still focus on generic drugs.

China is one of the most attractive pharmaceutical investment destinations

While the Chinese pharmaceutical market continues to face uncertainty on the back of challenges around drug pricing and the low levels of IP protection, China still presents one of the most attractive investment destinations in the Asia Pacific region. Underpinning this notion, China boasts a number of inherent advantages that makes it well positioned for continued FDI flows into the pharmaceutical sector. These include a rapidly aging population, a well-established manufacturing industry for pharmaceuticals, and notable government commitment to the sector’s development.

China’s dynamic pharmaceutical trade environment

As the largest pharmaceuticals market in the Asia Pacific, China presents a highly dynamic pharmaceutical trade environment. In 2018, China’s pharmaceutical imports were valued at $26.8 billion. This is forecasted to grow to $34.4 billion by 2023. In comparison, China’s pharmaceutical export value was $5.3 billion in 2018, and is forecasted to rise to $10.2 billion by 2023.

China imports pharmaceuticals from approximately 50 countries and areas. Most import sources are from developed countries and imported products are high-end and expensive. Imports are set to grow rapidly due to the implementation of the national essential medicine system, the new medical reform program, higher import prices of pharmaceuticals, and the improvement of R&D capability of domestic manufacturers.

The upward trajectory in the value of imports comes as China’s demand for medicines, especially innovative treatments, continues to grow in line with the country’s disease burden and healthcare modernization. Furthermore, boosted by growing demand for basic and high-quality pharmaceutical products, domestic demand is poised to remain strong moving forward.

Entering the Chinese Pharmaceutical Market – Good News for Foreign MNCs

Specific areas showing considerable market opportunities include:

Patent drugs for Tier-3 hospitals

Drugs for life-threatening diseases such as cancer, lung and liver diseases

New drug research and development

Pharmaceutical manufacturing

Off patent generic growth (as GQCE enforcement improves)

Strong Medicine sales growth

Rural and suburban areas

Pharmaceutical drug distribution

A vast aging population, increases in chronic diseases, and a burgeoning middle class and other factors have made China the fastest-emerging market for pharmaceuticals. China’s pharmaceutical market offers vast opportunity for multinationals as regulatory and other changes shift the landscape. Research firm IQVIA estimates the Chinese pharmaceutical market is worth at more than $122 billion. The scale of opportunity is momentous. But China is also a daunting pharmaceutical market, known for its red tape and lumbering drug approvals. There are positive signs that this is changing as China takes steps to overhaul its pharmaceutical sector.

Steps to improve regulation and licensing

China has taken considerable steps to improve the domestic market environment, specifically in terms of regulation and licensing operations for international companies. In 2019, the Center for Drug Evaluation and the CFDA reformed the application process for INDs and NDAs, allowing for accelerated review timelines that will bring both domestic and foreign drugs to market faster than ever before. Chinese regulators also eliminated the requirement to conduct clinical trials in China before drugs could be released, another regulatory prerequisite that had been slowing down the addition of new drugs to the Chinese market. Now, drugs that have been tested and approved for market in other countries will be fast-tracked for review without having to undergo China-specific testing.

Public insurance policies

In addition to a favorable regulatory atmosphere, China’s public health insurance policies have brought high-quality health care within reach to the average citizen. Hence, it seems the government remains committed to the improvement of healthcare access, exemplified by the universal healthcare scheme’s expansion to cover chronic diseases. Specifically, in a push to improve healthcare coverage, more than 100 Western medicines were added to public insurance policies in 2017, including AstraZeneca’s Brilinta (ticagrelor), and cancer treatments like Roche’s Herceptin (trastuzumab), MabThera/Rituxan (rituximab), Avastin (bevacizumab) and Tarceva (erlotinib). A further update in 2018 added more cancer treatments to the national reimbursement list.

Omnichannel marketing is growing in pharmaceutical companies

The biggest pharmaceutical e-commerce player is Jianke, a Guangzhou based company with 100 million customers and over 680,000 SKUs in 2018.

However, since the COVID-19 outbreak, many Chinese people began buying medicine on food delivery platforms like Meituan and Ele.me. This has eaten into Jianke’s market significantly because Ele.me and Meituan can deliver medicine within a half hour, compared to the 1 or 2 days it took Jianke to deliver. 87% of the products on these platforms are Western manufactured/ made pharma products.

The steps to order medicine online in China are quite simple, with confirming a prescription only adding a minor inconvenience.

Source: daxue consulting, ordering medicine in China through food delivery platforms

More R&D

Most of the top 20 multinational pharmaceutical companies have been expanding their footprint and are setting up more R&D facilities through various enterprise structures. One attraction for these companies is China’s relatively lower cost base, compared with developed markets globally. China’s large pharmaceutical market and its strong growth potential provide an impetus for international and domestic pharmaceutical firms to develop medicines, specifically for the country’s domestic market. Chinese consumers prefer multinational firm’s pharmaceutical products due to concerns over the quality of domestic drugs as China has been a prolific source of counterfeit and defective medicines.

Lifestyle-related diseases, like diabetes in China, are a growing concern for governments. Driven by an aging population, changing lifestyles and increasing urbanization, China’s rising non-communicable disease burden will be a central factor supporting pharmaceutical market growth. This, combined with various government incentives to improve access to treatment will progressively support a greater multinational drugmaker presence.